When you think about your small business or personal financial situation, you are most likely thinking about it in terms of a cash basis. Using a cash basis is the most common method of accounting for small businesses and personal finance. Accounting methods refer to how companies keep their financial records and prepare their financial statements. There are two main accounting methods used for record-keeping: the cash basis and the accrual basis. As a business owner, you must decide which method to use depending on several factors: sales volume, whether you extend credit to customers, guidelines set by the IRS, and your business legal structure. It is required by law that every business entity must keep some form of financial records. More importantly, financial records will be used for tax purposes and decision-making within the business. Therefore, it is essential you choose the most suitable accounting method for your business. If you’ve previously made an election with the IRS on your accounting method, it is possible to change methods, but it can be complicated, and you will need to pay a small fee to the IRS.

What is Cash Basis?

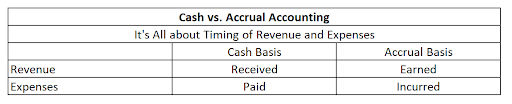

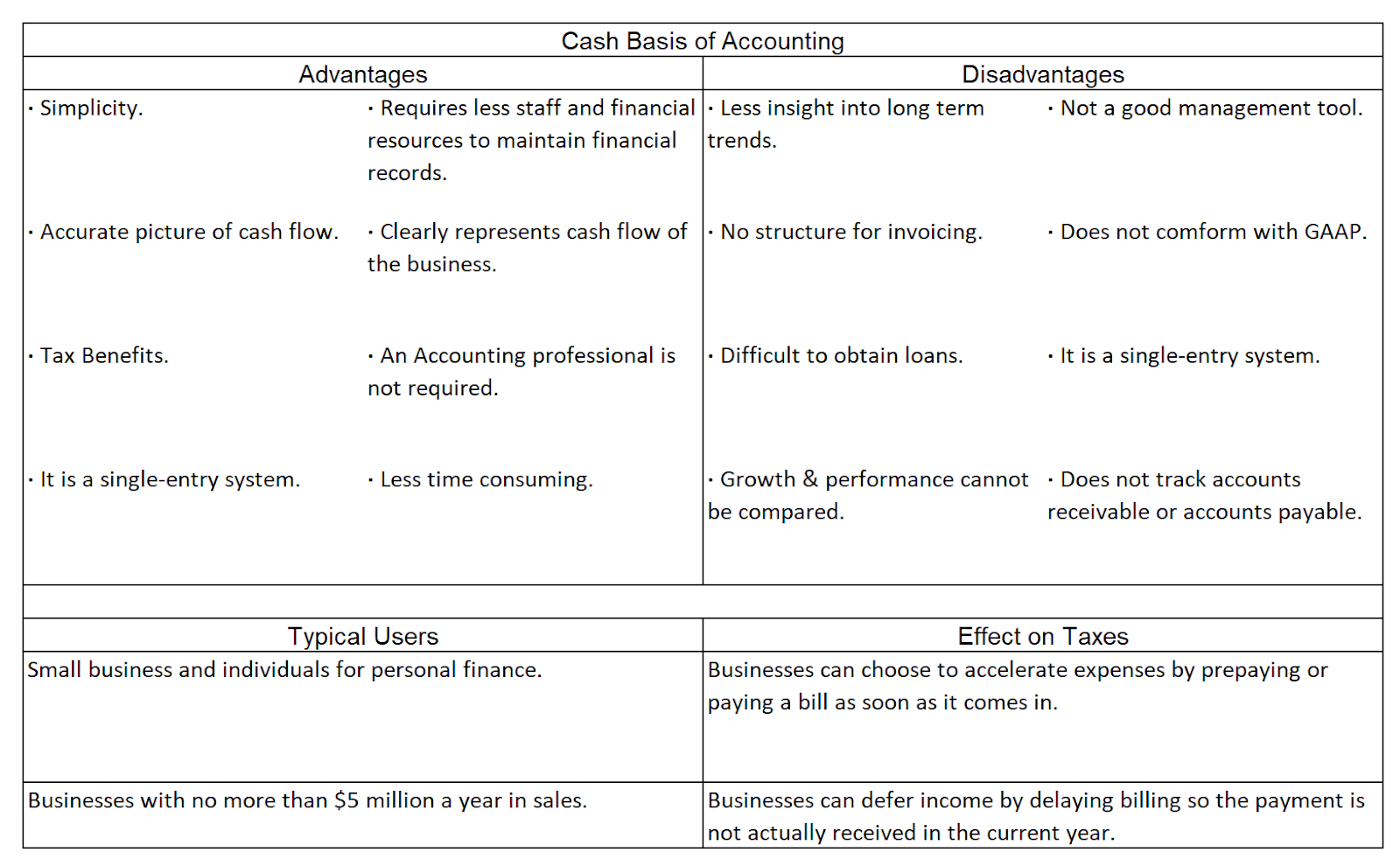

Cash basis accounting is the most widely used method by individuals and small businesses because it is the easier and simpler method. Cash basis recognizes income and expenses based on the real-time cash flow. Revenue is recorded when funds are received rather than when it is earned. Expenses are recorded as soon as they are paid, rather than when the costs are incurred. A business owner could defer taxable income by delaying billing, so the payment is not actually received in the current tax year. A business owner can accelerate expenses by prepaying or paying a bill as soon as it comes in rather than according to the due date. Since there are no complex accounting transactions such as deferrals of revenue or accruals for expenses, this is the easiest method. However, the relatively random timing of revenue and expenses will result in variations with unusually high and low profits. The cash basis method of accounting is only available for use if a business has no more than $5 million in sales per year, does not extend credit to customers, and if the business legal structure permits the use of cash basis.

What is Accrual Basis?

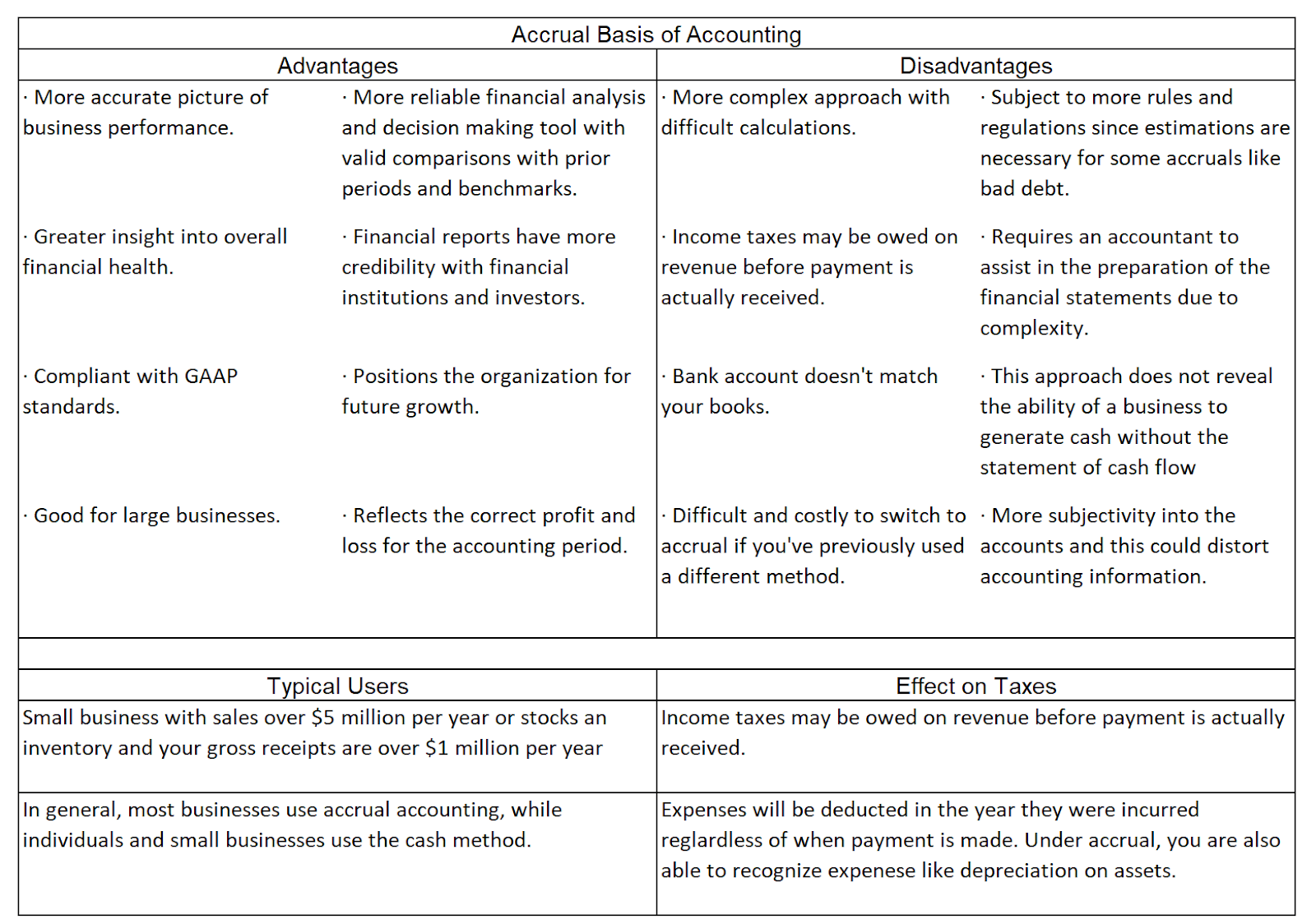

All larger companies use the accrual basis. This method recognizes revenues and expenses, regardless of whether a monetary transaction has occurred. Revenue is recorded when earned, and expenses are recorded once they are incurred. Larger companies use the accrual method for several reasons. First, its use is required for tax reporting purposes when sales exceed $5 million. The accrual method’s financial results are more likely to match revenues and expenses in the same reporting period, providing its true profitability. However, unless a statement of cash flows is included in the financial statements, this method does not reveal a business’s ability to generate cash.

Under generally accepted accounting principles (GAAP), the accrual basis of accounting is required for all businesses that handle inventory, from small retailers to large manufacturers. It is also required for corporations and partnerships with gross sales over $5 million per year. However, there are exceptions for farming businesses and qualified personal service corporations—such as doctors, lawyers, accountants, and consultants. A company that chooses to use the accrual basis must use it consistently for all financial reporting and credit purposes.

Key Difference Between Cash and Accrual Basis

- The cash method is simple, and it only accounts for cash paid or received.

- Tracking the cash flow of a company is easier with the cash method.

- The cash method might overstate the health of a cash-rich company but has large sums of accounts payable that far exceed the cash on the books and the company’s revenue streams.

- The accrual method includes accounts receivables and accounts payables providing a more accurate picture of the profitability.

- The accrual method can be more complicated to implement since it’s necessary to account for unearned revenue and prepaid expenses.

Can You Switch From Cash to Accrual?

Yes, it is possible to switch from cash to accrual. As a company grows, it will be required to switch from cash to accrual if it becomes large enough. If you switch from cash to accrual accounting, you will need to receive permission from the IRS by filing Form 3115. This IRS document allows you to request a change in your overall method of accounting or accounting treatment of any item. You must attach your profit and loss statement and balance sheets from the year before as well. When you are filing for the automatic change option, you must fill out all three parts of the form. If you qualify, you are given automatic approval by the IRS. Here are the things you must do before switching your books from cash to accrual accounting:

- Add your accrued and prepaid expenses to the financial statements.

- Add accounts receivable and payables to the balance sheet.

- Subtract cash payments, cash receipts, and customer prepayments

Since accrual accounting’s basic concept is to match income and expenses to the period in which they occur, converting from cash to accrual accounting essentially means adjusting the discrepancies between the timing of cash payments/receipts and the actual exchange of goods or services.

Conclusion

Cash and accrual accounting methods are both common in practice. Business owners should understand their advantages and disadvantages and choose the best-suited method for their company based on short- and long-term business objectives and strategies. Firms that need to convert from cash to accrual accounting should act early and allow sufficient time for a smooth and comprehensive transition from one method to the other.